Similarly, arranging liabilities in the order of discharge ability means putting short-term obligations that are payable in the immediate future first and long-term and more permanent liabilities at the bottom. Current assets include assets that can be converted into cash as early as possible (typically within the next 12 months). Current asset accounts include cash, accounts receivable, and inventory. To create a balance sheet, you have to follow an order and prepare a few things first—like you would have to do for many other business processes. Returning to our example of Edgar Edwards in Activities 1 and 2, the completed trial balance contains all the elements of the accounting equation.

The rise and continuing fall of Sam Bankman-Fried: A step-by-step guide to his case so far – Yahoo Finance

The rise and continuing fall of Sam Bankman-Fried: A step-by-step guide to his case so far.

Posted: Thu, 31 Aug 2023 16:01:00 GMT [source]

Only the real and personal account balance gets displayed on the balance sheet. On trial balance, you can view the three accounts, namely – personal, real, and nominal accounts. The term income statement is also known as the statement of operations or statement of income.

Trial Balance vs. Balance Sheet

Companies can use a trial balance to keep track of their financial position, and so they may prepare several different types of trial balance throughout the financial year. A trial balance may contain all the major accounting items, including assets, liabilities, equity, revenues, expenses, gains, and losses. A trial balance can be used to detect any mathematical errors that have occurred in a double entry accounting system. Once a book is balanced, an adjusted trial balance can be completed.

It could be time to buy this biotech stock – smarts.thestreet.com

It could be time to buy this biotech stock.

Posted: Mon, 28 Aug 2023 20:00:00 GMT [source]

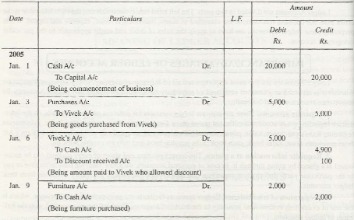

Figure 1 below shows the general ledger and the three categories of T-accounts therein that we have discussed so far. This is the accounting process in action, and we now have two key reports that provide valuable information and will allow us to make good financial decisions. Debits are the side of an account which shows the increase in assets, decrease in liabilities and capital. Credits means opposite i.E., Decrease in assets, increase in liabilities or capital accounts. For understanding trial balance, one should be aware of the Double entry system, journal and ledger. Each transaction is entered twice which is of opposite nature is called the Double entry system.

What is a Trial Balance

It reflects the assets – what the company owns, and liabilities – what the company does. For example, Celadon Group misreported revenues over the span of three years and elevated earnings during those years. This gross misreporting misled investors and led to the removal of Celadon Group from the New York Stock Exchange. Not only did this negatively impact Celadon Group’s stock price and lead to criminal investigations, but investors and lenders were left to wonder what might happen to their investment. Arranging assets in the order of liquidity means putting assets that can be readily converted into cash at the top of the list and more permanent assets at the bottom.

He is an enthusiast of teaching and making accounting & research tutorials for his readers. If you want to build on the skills and knowledge gained from studying this course, you might be interested in taking the Open University course B124 Fundamentals of accounting. Using the figures from our Trial Balance, simply fill in the blanks on the Balance Sheet below. Both formats are commonly used, and are simply different methods of displaying the same information.

AccountingTools

The balance sheet accounts and their balances are sorted into assets, liabilities, and owner’s equity to create the balance sheet. There are five sets of columns, each set having a column for debit and credit, for a total of 10 columns. The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. After a company posts its day-to-day journal entries, it can begin transferring that information to the trial balance columns of the 10-column worksheet. A trial balance is an internal report that lists all financial accounts and their ending balances on a specific date.

Thinking about hiring an accounting firm for help preparing your balance sheet? Browse our list of top accounting firms and learn more about their services in Capterra’s hiring guide. Noncurrent assets include assets that cannot be converted into cash within the next 12 months. Examples are plant/factory, machinery, furniture, and patents and copyrights (intangible assets). A general journal is the first place where daily business transactions are recorded by date. Depending upon the practice followed in an organization, some may keep specialized journals such as a sales journal, cash receipts journal, and purchase journal to record specific types of transactions.

For example, there may be multiple cash accounts in the trial balance that should be aggregated into a single “cash” balance sheet line item. Because of the time required to compile these, irs instructions 1065 schedule k trial balances and balance sheets were created only as needed at the end of a quarter or a year. Today, these can be created in most accounting systems nearly instantly with a few clicks.

Example of balance sheet preparation

The trial balance shows the double-entry rule that ‘for every debit there is a credit’. Your answer should have the correct debit or credit balance for each of the relevant six accounts as well as the total for all debit and credit balances. Balance sheet is prepared at the end of financial year to ascertain the financial position of an organization. According to this equation, an organization’s assets must be balanced by the sum of its liabilities plus shareholders’ equity.

- As discussed earlier, with the help of a balance sheet report, you can estimate and analyze the particular date’s financial position.

- You will not see a similarity between the 10-column worksheet and the balance sheet, because the 10-column worksheet is categorizing all accounts by the type of balance they have, debit or credit.

- If the total of the debit balances do not equal the total of the credit balance then there is a mistake somewhere, which needs to be investigated and corrected.

- Accounts payable and accrued payroll taxes are some commonly used current liability accounts.

The balance sheet summarizes the recorded amount of assets, liabilities, and shareholders’ equity in a company’s accounting records as of a specific point in time (usually as of the end of a month). It is constructed based on the accounting standards described in one of the accounting frameworks, such as Generally Accepted Accounting Principles or International Financial Reporting Standards. The first question we need to ask ourselves is what is a balance sheet, when to prepare it and why we need it in our business.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finally, press Enter and you will have the liabilities segment completed. Follow Khatabook for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting. When one of these statements is inaccurate, the financial implications are great. Amita Jain is a writer at Capterra, covering the branding and accounting markets with a focus on emerging digital enablement tools and techniques. A public policy graduate from King’s College London, she has worked as a journalist for an education magazine.

Unearned revenue had a credit balance of $4,000 in the trial balance column, and a debit adjustment of $600 in the adjustment column. Remember that adding debits and credits is like adding positive and negative numbers. This means the $600 debit is subtracted from the $4,000 credit to get a credit balance of $3,400 that is translated to the adjusted trial balance column. The trial balance information for Printing Plus is shown previously.

This demonstrates that for every transaction the basic principle of double-entry accounting has been followed – ‘for every debit there is a credit’. Balance sheet is one of the important fundamental financial statements for both accounting and financial modeling. This sheet consists of the company’s assets, liabilities and equity.Balance sheet consists of two sides.

Step #3: Calculate the total assets

The accounts are then aggregated to a general ledger at the end of the accounting period. The general ledger acts as a collection of all accounts and is used to prepare the balance sheet and the profit and loss statement. The trial balance includes the closing balances of assets, liabilities, equity, incomes and expenses. The income and expenses balances will be recorded in the income statement while the balances of assets, liabilities and equity will be recorded on the balance sheet. The line items in the balance sheet are usually far fewer than the line items in the trial balance, so aggregate the trial balance line items into the ones used in the balance sheet.