Contents:

The rules vary state to state, and your residency can affect your certification status in certain states . An Accounting Major is analytical and good at taking the big picture into account when trying to solve a problem. Loan officers evaluate, authorize, or recommend approval of loan applications for people and businesses.

- Talk to your bookkeeper to find out what you can offset, and beware of pitfalls.

- One of the big benefits of having up-to-date accounts is getting paid faster.

- Danielle Bauter is a writer for the Accounting division of Fit Small Business.

It can easily be turned into an invoice once the service or goods are delivered. And because your customer is already aware of the estimated costs, it’s easier for them to pay you faster. Setting and sticking to a budget will help you manage your cash flow and ensure you have organized tax records. Someone who is knowledgeable about United Kingdom Tax and filing with HMRC. We encourage all clients seeking Bookkeeping services to post their projects here on Freelancer.com. By doing so, you’ll be able to tap into our global talent pool and find the perfect Bookkeeper who will deliver exceptional results that meet your expectations.

Alternatives to Becoming a Bookkeeper

If you seek funding from a accounting equation or investor, your business plan will be especially important because it is how potential lenders and investors will understand your business. Deciding what to charge your clients is often a difficult process. You will want to do your research before pricing your services, and you will also want to maintain some level of flexibility to adjust your rates in the future. According to the Bureau of Labor Statistics , entry-level bookkeepers don’t have a degree. Instead, candidates rely on a combination of existing skills and on-the-job training to be successful in the workplace.

To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. While it’s not required for bookkeepers to specialize in a niche, many choose to do so for marketing purposes. If you focus on a specific industry, you can gain referrals from others within the industry and join industry associations. Add your bookkeeping business to relevant online business directories.

You will need to learn how to start a bookkeeping business in your location, such as how to file for a license if you choose to have an in-person office. Bookkeepers are not required to have certifications or specific education unless required by a specific employer. Bookkeeping is a great place to start if you’re hoping for a way to break into the finance industry.

How to Become a Virtual Bookkeeper

So far it’s working out well, and she feels great about lifting some of that work off herself. For that first client Kate secured at the speed networking event, she charged $20 per hour. In the US, there are no formal certifications required to call yourself a bookkeeper. Before investing in a course though, it might make sense to work through some free resources, like these at AccountingCoach.com. Most free courses will give you to baseline technical education to feel comfortable doing the work, but won’t cover the “business” side of becoming a bookkeeper.

This makes bookkeeping a popular choice for those without degrees or those ready for a career change. This role will be a primary contributor to the month-end and year-end general ledger close process and will assist in other projects as needed. BA/BS degree and 2+ years of progressive experience in accounting, specifically GAAP-compliant accounting… This person will be responsible for financial and operational reporting and analysis, as well as management of the global accounting team.

Bookkeeper duties and responsibilities of the job

Organize Financial Records —Organization is the heart of bookkeeping. Depending on the size or style of business, this organization process can change dramatically. A family-owned antique store will not require the same financial organization as a rapidly growing law firm, for example. Assets— All the things that a company owns to run its business.

Savvy Senior: Tips for retirees to find fun part-time work – Las Vegas Review-Journal

Savvy Senior: Tips for retirees to find fun part-time work.

Posted: Thu, 23 Mar 2023 07:00:00 GMT [source]

Danielle is a writer for the Finance division of Fit Small Business. She has owned a bookkeeping and payroll service that specializes in small business, for over twenty years. The BLS offers detailed data on pay, location, and availability of different kinds of jobs across the country. Good areas of accountancy to look at with a Master’s include taxation and auditing-related jobs. Not a certification itself per se, but CPEs are required in order for you to maintain your licensure. Failure to attain your CPE within a certain degree of time can result in your CPA status being revoked or marked inactive.

You can log in from anywhere at any time to help manage your clients’ books or answer questions. Businesses of all kinds will always need bookkeeping services. If you’re considering becoming a bookkeeper, read our guide to learn how to start a bookkeeping business in 2023. We’ll cover everything from the legal side of registering a new business to pricing, marketing and more. If you’re interested in becoming a QuickBooks Live bookkeeper, Intuit can provide you with the tools necessary to learn bookkeeping and accounting skills and get certified. Get started by signing up for the Intuit Bookkeeping Certification program today.

7 Splurges You’ll Never Regret – AOL

7 Splurges You’ll Never Regret.

Posted: Wed, 19 Apr 2023 19:00:26 GMT [source]

Thanks to technology, there are programs that can automatically process a lot of the calculating and sorting that bookkeepers used to do manually. Bookkeepers do more than just crunch numbers and track receipts. They are in charge of some of the most important tasks in overall accounting.

Step 2: Gain bookkeeping skills

Maybe you enjoy the idea of being your own boss, or you’re still wondering if it’s for you. You only need a few basic skills to get started in bookkeeping. These don’t require you to go to school or gain any special training, but they may be skills you’ll need to develop over time. But as with any other enterprise, running your own bookkeeping business takes some key elements of preparation and knowledge.

Best Work-from-Home Jobs [2023]: Ditch the Morning Commute – Yahoo Finance

Best Work-from-Home Jobs : Ditch the Morning Commute.

Posted: Sat, 25 Feb 2023 08:00:00 GMT [source]

In an interesting turn of events, her bookkeeping business spun off another side hustle. What started out as offering advice to people in a financial independence Facebook group, turned into a small concentrated group of people in her own Facebook group. However, almost all of Kate’s clients have come from word-of-mouth. Just by telling everyone she knew about her new virtual bookkeeping business, she landed enough customers to keep busy. To get accepted, she had to take a 5-hour test of bookkeeping tasks. Once in, Kate said their sales team worked to find small businesses in need of bookkeeping services to introduce her to.

- This involves working with a variety of financial institutions and posting systems.

- If you are ready to leap into the industry with both feet first, consider the following tips to start your bookkeeping career.

- While the education gained in the classroom is without a doubt beneficial, you’ve learned more from your accounting degree than just how to memorize accounting principles m.

She is a former Google Tech Entrepreneur and she holds an MSc in International Marketing from Edinburgh Napier University. Once you’ve settled on a business name, you’ll need to register your business in the state in which you will do business. Professional associations also offer certifications so that you can hone your skills and market yourself as a professional bookkeeper.

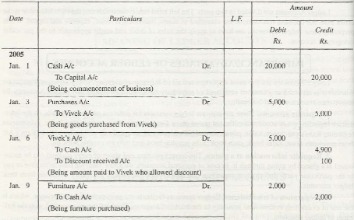

Talk to people in your network who are also bookkeepers and ask what they are charging. In doing so, you can get a good idea as to the range bookkeepers charge for services. Bookkeeping is a part of the accounting process that involves recording financial transactions.