A balance sheet organizes all of this information in a way that is easy to read and understand. You can create yours today with the help of the balance sheet template from FreshBooks. With the balance sheet template Google Sheets provides, you’ll be filling in fields with ease.

Owners’ equity section

Stock general accounting definition investors, both the do-it-yourselfers and those who follow the guidance of an investment professional, don’t need to be analytical experts to perform a financial statement analysis. Today, there are numerous sources of independent stock research, online and in print, which can do the “number crunching” for you. However, if you’re going to become a serious stock investor, a basic understanding of the fundamentals of financial statement usage is a must. In this article, we help you to become more familiar with the overall structure of the balance sheet. The term balance sheet refers to a financial statement that reports a company’s assets, liabilities, and shareholder equity at a specific point in time. Balance sheets provide the basis for computing rates of return for investors and evaluating a company’s capital structure.

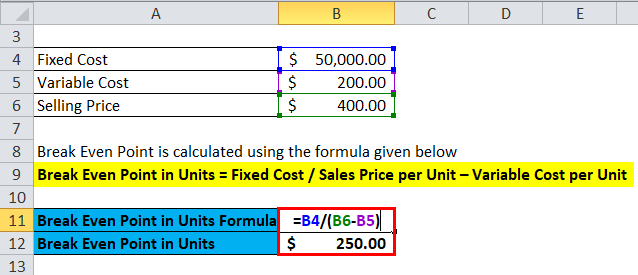

The balance sheet is basically a report version of the accounting equation also called the balance sheet equation where assets always equation liabilities plus shareholder’s equity. A balance sheet template is a tool for tallying your assets and liabilities so that you can calculate your equity. Use a balance sheet template to ensure you have sufficient funds to meet and exceed your financial obligations. Download one of these free small business balance sheet templates to help ensure that your small business is on track financially. In the asset sections mentioned above, the accounts are listed in the descending order of their liquidity (how quickly and easily they can be converted to cash).

How Balance Sheets Work

Ready to take it to the next level and start working with international clients and investors? Get a Wise multi-currency business account to accelerate your business growth. FreshBooks offers a variety of free accounting templates for business owners like you who are trying to take their accounting into their own hands. To keep things simple, the free balance sheet template from FreshBooks help you manage your numbers with ease.

Free Small Business Balance Sheet Templates

Ensure that you meet your financial obligations and solvency goals with this easy-to-use monthly balance sheet template. Enter your assets — including cash, value of inventory, and best invoicing software of 2021 short-term and long-term investments — as well as liabilities and owner’s equity. Completing the form will provide you with an accurate picture of your finances. Use this monthly or quarterly small business balance sheet template to analyze and archive your business’s assets, liabilities, and equities over monthly, quarterly, and year-to-date timelines. The spreadsheet will automatically calculate short term and long-term assets and liabilities every quarter and at the end of each year. Common financial ratios are calculated using total and current liabilities and equity.

Enter line items to quickly calculate your current and long-term assets, current and long-term liabilities, and owner’s equity. Once completed, you can identify where to make adjustments to improve profit and net worth. A company’s balance sheet is one of three financial statements used to give a detailed picture of the health of a business. Investors and analysts will read the balance sheet alongside the income statement and cash flow statement, to evaluate the company’s overall financial position.

- Some companies issue preferred stock, which will be listed separately from common stock under this section.

- Current liabilities are the obligations that are expected to be met within a period of one year by using current assets of the business or by the provision of goods or services.

- A balance sheet is a financial report that lists your business’s assets, liabilities and equity.

- Without context, a comparative point, knowledge of its previous cash balance, and an understanding of industry operating demands, knowing how much cash on hand a company has yields limited value.

- As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

The income statement and statement of cash flows also provide valuable context for assessing a company’s finances, as do any notes or addenda in an earnings report that might refer back to the balance sheet. The three core financial statements—income statement, balance sheet, and cash flow statement—are intricately connected and collectively present a comprehensive view of a company’s current financial condition. Companies, organizations, and individuals use balance sheets to easily calculate their equity, profits, or net worth by subtracting their liabilities from their assets. By doing so, they can get an overall picture of their financial health. A balance sheet also serves as a company or organization’s financial position over specified time, such as daily, monthly, quarterly, or yearly.

Choosing the right business balance sheet template or you will depend on your preferred programs as well as your business needs. Designed with secondary or investment properties in mind, this comprehensive balance sheet template allows you to factor in all details relating to your investment property’s growth in value. You can easily factor in property costs, expenses, rental and taxable income, selling costs, and capital gains. Also factor in assumptions, such as years you plan to stay invested in the property, and actual or projected value increase.

The balance sheet reflects the carrying values of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. The asset section is organized from current to non-current and broken down into two or three subcategories. This structure helps investors and creditors see what assets the company is investing in, being sold, and remain unchanged. Ratios like the current ratio are used to identify how leveraged a company is based on its current resources and current obligations. Track your quarterly financial position by entering each month’s assets and liabilities and reviewing the monthly and quarterly perspectives of your owner’s equity. Monthly columns provide you with assets, liabilities, and equity tallies, and also reflect three-month figures for each quarter.