Content

Given that the whale was assumed likely to just walk away, the hole in the balance sheet is now someone else’s problem, and it grew as SOL declined. Now your brokerage has a few choices, and none of them are fun, because someone has lost money and that can never be made fun. The value destruction has already happened, principally at Google.

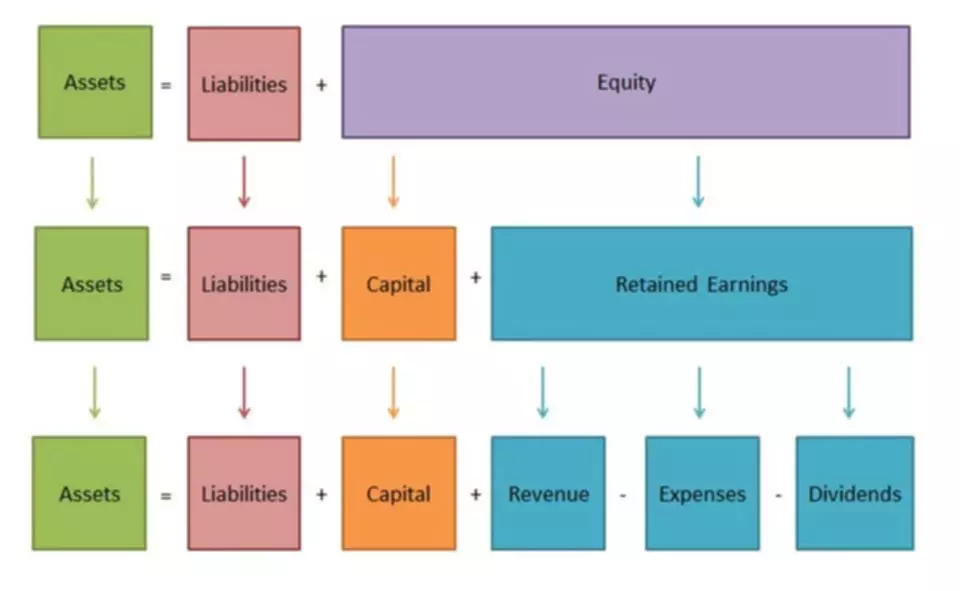

This is anachronistic lingo to require you to either deposit more cash or sell stock. How much impairment to assets can the bank take before its equity is exhausted? If you know the leverage ratio, you can mental math out an approximation trivially. Bam, that’s how much of a decline in the value of the assets wipes out the equity.

Advantages & Disadvantages of Financial Leverage

However, an unexpected and sharp surge in interest rates may induce policyholders to surrender their contracts at a higher-thanexpected rate, potentially causing some funding strains. Meanwhile, leverage at P&C insurers remained low relative to historical levels. In addition, leverage can be used to increase the potential for capital gains.

How does leverage work example?

The leverage ratio shows how much the trade size is magnified as a result of the margin held by the broker. Using the initial margin example above, the leverage ratio for the trade would equal 100:1 ($100,000 / $1,000). In other words, for a $1,000 deposit, an investor can trade $100,000 in a particular currency pair.

However, it is important for investors to have a thorough understanding of financial leverage and a comprehensive risk management strategy in place in order to protect their investments. When using financial leverage, it is important for investors to have a comprehensive risk management strategy in place to protect their investments. This includes setting stop losses or other limits on any leveraged investments and monitoring the market conditions closely. Additionally, investors should diversify their investments across different asset classes and sectors in order to reduce risk.

Decentralized finance innovations in leverage management

Your financial leverage has the potential to improve your quality of life, such as buying a home you love or starting a meaningful business. In addition to making the purchase, rental properties require ongoing maintenance and repairs. There are also property taxes, homeowners insurance and other recurring expenses. The leverage magnifies the firm’s profit while increasing the potential for loss. A higher value of leverage signifies that a company has more debt than equity. Baker’s new factory has a bad year, and generates a loss of $300,000, which is triple the amount of its original investment.

Debt financing comes with fixed financial costs (i.e. interest expense) that remain constant regardless of a company’s performance in a given period. Experts have identified appropriate leverage ratios for different industries. Your lender can help you determine your ratio to see if it’s in line.

AccountingTools

Financial leverage tells us how much the company depends on borrowing and how it generates revenue from its debt or borrowing. Calculating this is a simple total debt to shareholders equity ratio. If the investor only puts 20% down, they borrow the remaining 80% of the cost to acquire the property from a lender. Then, the investor attempts to rent the property out, using rental income to pay the principal and debt due each month. If the investor can cover its obligation by the income it receives, it has successfully utilized leverage to gain personal resources (i.e. ownership of the house) and potential residual income. Although debt is not directly considered in the equity multiplier, it is inherently included as total assets and total equity each has direct relationships with total debt.

A corporation that borrows too much money might face bankruptcy or default during a business downturn, while a less-leveraged corporation might survive. An investor who buys a stock on 50% margin will lose 40% if the stock declines 20%.; also in this case the involved subject might be unable to refund the incurred significant total loss. Financial leverage is the strategic endeavor of borrowing money to invest in assets. The goal is to have the return on those assets exceed the cost of borrowing funds that paid for those assets.

Financial crisis of 2007–2008

If the https://www.bookstime.com/ price of the security declines, the lender will want the investor to repay the loaned funds, possibly resulting in the investor being wiped out. The degree of financial leverages is called the leverage ratio, which helps measure the sensitivity of the earnings per share to the fluctuations in the company’s income. Is a shoe manufacturing company based in Brisbane that is planning to get a loan to expand its business. But, before getting a loan, they have to know their financial leverage, given the total debt accounts for $76,000 and the shareholder’s equity is $1,15,000.

A firm may face this due to incompetent business decisions and practices, eventually leading to bankruptcy. Whereas, if the value of financial leverage is low, a company issues many equity and financial securities to raise funds for business growth. At the same time, the risk is also increasing as the risk-on market is high, and the market is too volatile.