Содержание

The course also includes ongoing support, such as access to a community of traders and regular webinars with the course instructors. It can take 1-5 years to learn futures trading, but these results aren’t typical. Many factors go into becoming a successful trader, such as learning technical analysis and having the proper discipline and mindset. Yes, we work hard every day to teach day trading, swing trading, options futures, scalping, and all that fun trading stuff.

For example, say you buy stocks worth INR 100,000 in the futures market with a 20% margin (i.e. INR 20,000 in this example). To execute this contract, you have to keep INR 20,000 with your broker. If the stock goes up 10%, you have made a INR 10,000 profit while putting up only INR 20,000. Therefore, your profit margin is 50% and not 10% like it would have been if you actually bought the stock. The flip side, of course, is that the same logic applies to your losses. Further, if your losses deepen, you may be required to post additional margin.

Pros & Cons of Futures Investing

Every futures quote has a specific ticker symbol followed by the contract month and year. Futures can fit into your overall trading strategy in several ways. Make sure you’re clear on the basic ideas and terminology of futures.

But these aren’t the be-all-and-end-all of futures trading. In fact, there’s a wide range of choices from which you can choose. There are certain risks inherent in futures trading that you won’t find anywhere else. Among these are price sensitivity and margin trading, https://forexbitcoin.info/ which means that you use leverage or borrowed capital to make your trades. Learn the basics of the markets and trading stocks, futures, options, and crypto. Futures and options assets are heavily leveraged with futures usually seeing a harder sell than options.

Feel free to ask questions of other members of our trading community. We realize that everyone was once a new trader and needs help along the way on their trading journey and that’s what we’re here for. Our watch lists and alert signals are great for your trading education and learning experience.

Step 4 – Choose your contract and month

Some traders like trading futures because they can take a substantial position while putting up a relatively small amount of cash. That gives them greater potential for leverage than just owning the securities directly. It is essential to watch expiry/settlement dates for futures contracts. Mainly because if you hold them for the full term, there will be additional costs to consider.

- Bypass the tutorial and start trading now using our practice simulator.

- Some traders specialize in 1 or 2 futures sectors simply because they have an edge and understanding of those markets’ fundamentals and economic trends.

- Some of the most important aspects to choosing the right broker includes margin requirements, order execution, and how good their charts are.

- Join Topstep Senior Performance Coach, John Hoagland, for this deep dive into futures trading.

In typical futures contracts, one party agrees to buy a given quantity of securities or a commodity, and take delivery on a certain date. The E-mini S&P 500 turns over more than $100 billion in daily trades. That is solid evidence that futures contracts are a vital part of the investment landscape. There are numerous different types of parties active in the futures market. These include speculators, hedge funds, and those dealing with physical commodities such as grain, oil, etc. The cumulative impact of these various parties ensures that the more popular futures markets are extremely liquid.

Best Online Brokers for Stock Trading

So, while most futures contracts are closed before the expiration/settlement date, there may be occasions where a contract may be held until expiry. Futures contracts tend to have physical settlement (commodities, metal, etc.) or cash settlement dependent upon the proper setup. In the example of the E-mini S&P 500 Index futures contract, this would be a cash settlement. The amount is based on the value of the index on the contract settlement date. Let us assume that your long-term prediction about how the market will move is correct.

Stephens & Co. Reiterates Equal-Weight on Credit Acceptance … – Benzinga

Stephens & Co. Reiterates Equal-Weight on Credit Acceptance ….

Posted: Thu, 09 Mar 2023 15:04:57 GMT [source]

Don’t take claims of success at face value if you haven’t verified them. Also keep in mind that individual students who offer testimonials may be outliers who don’t represent success for students usgfx forex broker overview overall. And remember, past success doesn’t guarantee future success. Easy answers and secret tricks — Derivatives markets are complex, with many factors in play day-to-day and minute-to-minute.

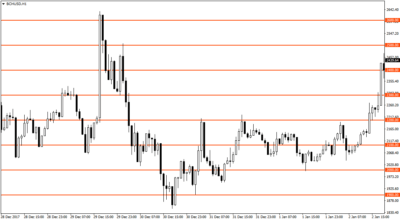

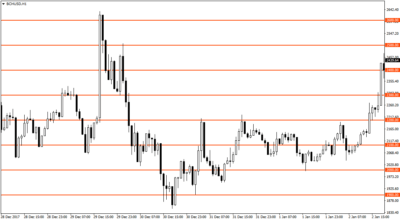

Liquidity risk

Market-on-Close order is an order that will be executed at the closing price of a daily session. It can be convenient for day traders who don’t want to hold their positions overnight. Check out trading insights for daily perspectives from futures trading pros. View futures price movements and trading activity in a heatmap with streaming real-time quotes.

Understand what it means to be a Topstep trader and learn what to expect throughout our program. There are no restrictions on the size of the account or the number of daily trades. Keep in mind that spread strategies are no less risky than directional strategies. A spread can go against you as much as a directional trade. Futures statements are generated both monthly and daily when there is activity in your account. They show key information like performance, money movements, and fees.

An extremely talented group of traders that offer a complete learning environment regardless of a person being new to trading or an experienced trader wanting to learn something new. I joined the Bullish Bears in May 2021 because someone shared a YouTube video of a trading technique I was interested in learning since I was struggling learning it from somewhere else. Once I joined the community, there were even more learning opportunities from the video library, the live streaming, the BB Team along with the BB community.

However, let’s not forget you can also use them as a tool for hedging. This means that you can protect an existing investment portfolio from market fluctuations by selling a futures contract. Therefore, if the market was to push forward before you received your investment funds, you will benefit from the increase in the value of the futures contracts.

Why Is Duluth Stock Trading Higher Today? – Duluth Holdings (NASDAQ:DLTH) – Benzinga

Why Is Duluth Stock Trading Higher Today? – Duluth Holdings (NASDAQ:DLTH).

Posted: Thu, 09 Mar 2023 18:18:25 GMT [source]

Going back to the corn futures example, the initial margin for 1 corn futures contract is $2,025. The initial margin is the amount of money that needs to be in the account to initiate a trade in the futures market. On the other side of the business spectrum, a company buys corn to make food products. And it is concerned that the price of corn will increase, which will make it expensive and negatively affect the bottom line. In order to lock in today’s price, it would buy corn futures contracts to offset rising prices.

They have hours and hours of the best video training available anywhere. Actual videos of live online trading concepts recorded in real time by EXPERTS. The absolute highest level of knowledge and experience I have ever encountered.

Searches related to trading

In those cases, each transaction can cause a drop in the index value. If you want to ensure a liquid market and ready buyers and sellers, stick to liquid futures contracts. Now that we’ve explored the basics, let’s put everything all together in a trading example using the E-mini S&P 500 futures. Say the S&P 500 index recently broke out to a new all-time high, and we want to fade the move, hoping to book profits on a retracement to the initial breakout area around $4,720. Our money management rules stipulate that we risk no more than 1% of our futures trading account on any one trade and our broker requires a margin of $12,000.

Secondly, equity in a futures account is “marked to market” daily. You can practice trading with “paper money” before you commit real dollars to your first trade. This is an invaluable way to check your understanding of the futures markets and how the markets, leverage and commissions interact with your portfolio. If you plan to begin trading futures, be careful because you don’t want to have to take physical delivery. Most casual traders don’t want to be obligated to sign for receipt of a trainload of swine when the contract expires and then figure out what to do with it. The investing information provided on this page is for educational purposes only.