Josh enjoys spending his free time reading books and spending time with his wife and three children. He is a how to open CUR files father of three and has been writing about (almost) everything personal finance since 2015. You can also find him at his own blog Money Buffalo where he shares his personal experience of becoming debt-free (twice) and taking a 50%+ pay cut when he changed careers.

- Extensions for your 2022 taxes must be submitted by the April 18th tax deadline.

- You can also pay by phone using the Electronic Federal Tax Payment System or by calling one of the debit/credit card payment processors approved by the IRS.

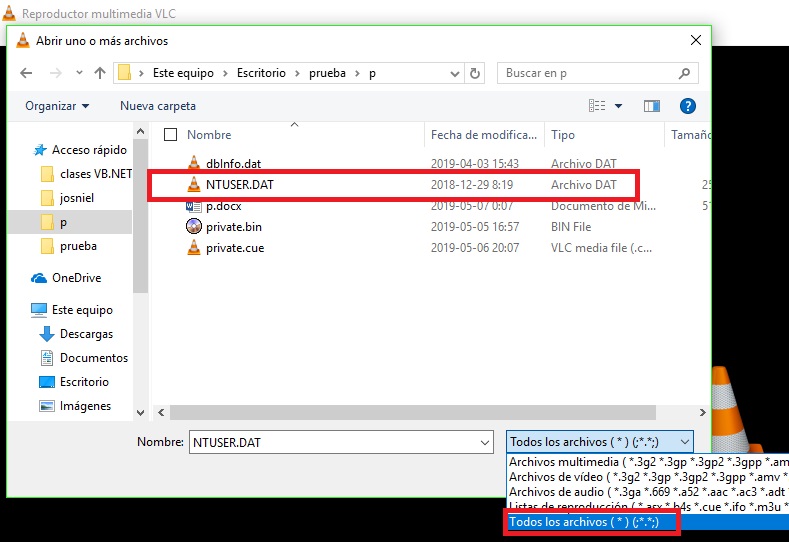

- On Chrome, Edge, and Safari, you can only convert to PNG on supported sites.

- Png images will automatically be converted to svg designs.

- As you can see above, the SVG is a decrease in file size of 92.51% when compared to the JPG.

The question is, how do you know what you owe in taxes without filing a return? You can prepare a return to get an estimate of taxes owed and e-file an extension even if you do not have all information at hand to file the return.

Opening SVG Files Using a Text Editor

Though an extension gives you an extra six months to complete your income tax return, it’s always best to file it as soon as possible. The longer you wait, the more likely you will forget what happened during the previous tax year. When you can’t make the filing deadline (usually April 15), you can ask the IRS for an extension. In most cases, the IRS can grant an automatic six-month extension.

Six months is generally the longest amount of time allowed for an extension for filing taxes, though there are certain exemptions to this general rule. Note that a federal tax extension does not mean that the deadline to submit your state taxes is extended; each state has its own requirements for filing an extension. Form 7004 is used to extend the deadline for filing tax returns (certain business tax, information, and other returns). The IRS Form 7004 offers businesses an extension of time that can vary from 5 to 7-Month extension after the due date of the tax return. If any of these exceptions apply, you’ll automatically receive an extension of time to file your tax return—you do not need to file for the extension.

How Do I Batch Convert JPG to PNG in Photoshop?

A void extension will subject the return to both a late filing penalty and a late payment penalty. Any portion of the tax not paid by the original due date of the return is subject to interest from that due date. Filing a tax extension can be a quick and simple process, giving you up to six months to file. But you’ll still have to pay owed taxes by the original tax filing deadline even if your extension is granted. Even if you’re used to filing taxes on time every year, sometimes you may need a little wiggle room to complete your federal tax return.